How to buy shares using hdfc demat

Being the most popular educational website in India, we believe in providing quality content to our readers. If you have any questions or concerns regarding any content published here, feel free to contact us using the Contact link below. SpiderWorks Technologies, Kochi - India. FORUM ARTICLES ASK EXPERTS EXAMS Exam Results Practice Tests Question Papers EDUCATION Admissions Learn English Universities Colleges Courses Schools STUDY ABROAD MORE Jobs Reviews Help Topics Digital Marketing Social Hub New Posts My India Post Content.

Ask Experts Finance and Investments Stock Market. I have HDFC demat account but I dont know how to proceed Have you opened your demat account but dont know how to trade online?

Learn online forex and share trading step by step guides from our experts here. I have HDFC demat account but I don't know how to proceed with trading here. Can anyone guide me how to do online trading and keep an eye on varations happening in market? Can you provide some reference links from where I can learn trading using my online account. It would be helpful if someone can share screenshots with me.

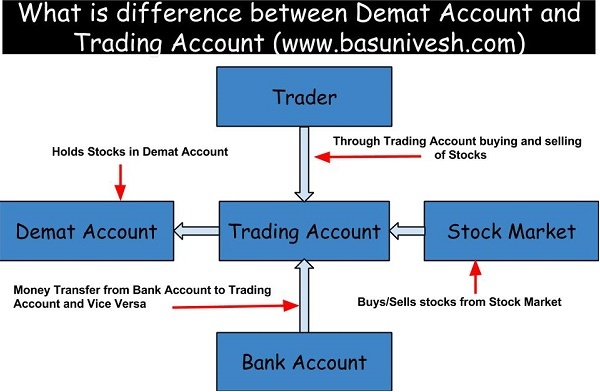

Demat is account is only for holding shares like you keep money in your savings bank account. To do online trade you need a trading account where you can buy and sell shares.

How to sell stock in HDFCSec

For this HDFC providinga 3in1 account. And yes Online trading is a smartcut way to make money so instead of trying to learn from Internet it needs more specification explanation so its better you go to HDFC bank and ask them for a demo about online trading and you can check live market every working day Monday to Friday 9: That can be a good exposure for you.

Earn in USD with out Investment. With the current HDFC demat account, You should have Saving Bank SB account and a trading account with the same bank. You can approach nearest HDFC trader for opening a trading account. For a SB account you have to approach a nearest HDFC Bank.

Page Redirection

These three accounts will be linked for on-line trading by the trader. This is the thing the trader will do for you. He can only give tips on trading and he may invite you to participate experts seminar for the purpose.

These will only initiate your trading.

In the beginning you can do on line trading in the premises of your trader which give exposure to on line trading. To become good on line trader, you have to get trained on your own by reading the tips on line, read books on technical analysis and there are many books available in market. Once trading is started, you have to keep records either off line or on line and on line will be more beneficial because you will get instant analysis on your portfolio which may assist you while trading.

There are many on line supporters are there which you can get through google search. Once you started using these packages, you have a platform there to share views and tips by so many members available there. Nice to be in ISC and feel the difference. There are many ways you can utilize your Demat Account. Demat account hold shares of a company you might be possessing in a form through which you can exchange them for money. However, you can't directly buy or sell shares through your Demat account, for that, you need to have a trading account with any of the stock brokers or bank.

The usefulness of the Demat account is as below. Holding of securities in electronic form and exchange them for money: As you have mentioned you have Demat account with HDFC bank, the bank will take care of your shares just like an ordinary bank which take care of your money.

They will also send you transaction statements from time to time. One advantage as compared to your savings bank account where you need to have a minimum balance and bank charges some amount upon non maintenance of minimum balance is that, you need not have to keep any minimum balance of securities in your Demat account.

As the Securities market regulator of India SEBI has made it mandatory to have Demat account for settlement of securities in electronic form, the Demat account is a must for any securities transactions. As you have a Demat account you can open a securities trading account with any of the renowned securities broking firms or Banks. I say a renowned securities trading firm because, if you are a beginner you need to understand a lot about the securities market and how they operate.

In case you are going for an online securities trading account, you have to be thoroughly trained. There are many securities brokers and banks with whom you can open a trading account. Now-a-days you can even bargain with them for the brokerage and make you deal cost effective. Holding mutual fund units in electronic form: You can hold your mutual fund investments in your Demat account. Whenever you want to buy mutual fund units, you can give the instruction duly filled up and submit to the respective Asset Management Company AMC.

The respective AMC will then credit the Units of the Mutual fund to your Demat account. As can be seen, this will help you to manage your investments well as managed centrally in one place. Automatic credit of benefits such as Bonus or rights issues: Your Demat account will be automatically credited with any bonus or rights share issue announced by any of the companies whose shares you are holding.

In case of cash dividend, your bank account will be credited with the bonus amount. Making nominees of Demat account: One can nominate anyone from your family who can receive the securities in case of his or her sad demise. Regards, Tulika Devi Nath. The purpose of opening Demat Account with a Stock Broker is to keep the safe custody of your shares purchased. It is same like a Bank Account where safe custody is money is credited to your Bank account.

For trading purpose you have 2 choices. You can trade directly with the Broker's office called offline account or through online account trade through internet at home.

For both you have to open a trading account with your Broker by filling an application form and by providing mandatory documents required to open the trading account like PAN card copy, passport photograph, address proof, bank statement etc.

Since you prefer online trading account, you better go to your Broker office and get details of different types of software the Broker is providing for online. Usually Stock Brokers provide two or three online software for online trading with different features and monthly charges.

You may clear all your doubts through demo trading. You have already savings account and demat account. To start trading you need to open a trading account also with them. After you can register in a brokerage firm online or offline.

Let them know the following thing about you 1. How much money you want to invest or teade. How often you will trade 3.

HDFC Securities Broker FAQs (Frequently Asked Questions)

You are intraday trader or long term trader. Intra day trader means buying and selling in a day. Or you can choose online registration in sharekhan. They will teach you how to invest and trade. You much know following things beforeyou start to trade.

Long term investment will give a goodn return to you. Also risk is less. If you are a intaday trader, then you must know about technchal analysis like moving average, 52 week high and low, call put option etc.

This is very risk investment. You should sit whole day for it Regards, Shaji. Subscribe to Email Get Jobs by Email Forum posts by Email Articles by Email. Top Contributors Today Naveen Vamar 82 Ravishankar 62 DR. EDUCATION Universities Colleges Schools Courses Admissions Question Papers Exam Results Practice Tests Distance MBA.

Education Leads Advertise Make Money. About Us Contact Us Copyright Privacy Policy Terms of Use.