Exercise stock options tax implications

This is really a tax question and should be answered by an accountant. The answer and tax consequence is not straight forward since it will depend on the type of stock option and your particular financial situation.

Employee Stock Options: Definitions and Key Concepts

One very important thing to considered is timing. Once you exercise your options if you do not sell your shares at the same time and the value of the shares drops you may experience a financial loss.

Nick and Lyman have covered the tax basics to consider on stock options and both are correct that specific tax questions should be addressed by your tax professional.

Incentive Stock Options - TurboTax Tax Tips & Videos

All I would add is that stock options can be a very valuable piece of your financial planning. Optimizing stock options is the expertise of certified financial planners. Aside from tax considerations, make sure you are optimizing your options in concert with your overall financial plan.

The mechanics of stock options outlined by Lyman are very thorough and should be read by anyone interested in learning about the various kinds of stock options and the rules. He also recommends consulting a tax advisor.

I also recommend this. I have had accountant develop different scenarios to give clients an idea about tax liability as well as the appropriate ration of exercise and sell and exercise and hold. ISOs and NQSOs , for other incentives ie.

RSUs you may not.

Non-Qualified Stock Options - TurboTax Tax Tips & Videos

And you have no control over that. The day they vest, you have ordinary income, generally reported on your W-2, and your cost basis in the shares is set that day.

With NQSOs and ISOs, you m NerdWallet strives to keep its information accurate and up to date. All financial products, shopping products and services are presented without warranty.

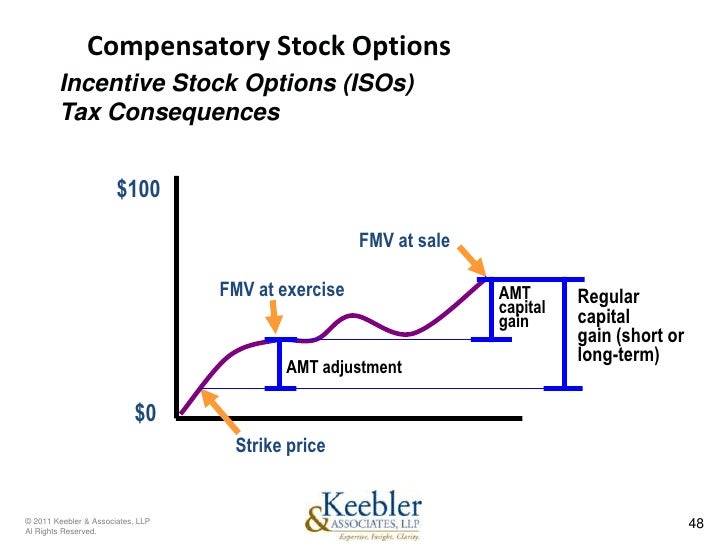

Stock Options and the Alternative Minimum Tax (AMT)

Pre-qualified offers are not binding. So how do we make money?

We receive compensation from our partners when someone applies or gets approved for a financial product through our site. But, the results of our tools like our credit card comparison tool and editorial reviews are based on quantitative and qualitative assessments of product features — nothing else.

Log in Sign up. Sign Up Log In. What are the tax implications of exercising my stock options? For example, say there is a tax consequence at the time of exercise and you also d The others have addressed many of the tax details, but I'd like to add two points here: Related Questions I have an IRS tax lien on my property.

If I leave my job and cash out my pension and deferred compensation, will the IRS take My mother is dying and wants to put her house in my name. Will I have to pay capital gains if I sell right away after she dies? I owned a second home for 20 years with no rental income. What is the capital gains rate? Credit Cards Banking Investing Mortgages University Partners. Insurance Loans Shopping Utilities Taxes.

About Company Press Careers Leadership. Terms of Use Privacy Policy.