What are forwards futures call put options bonds debentures

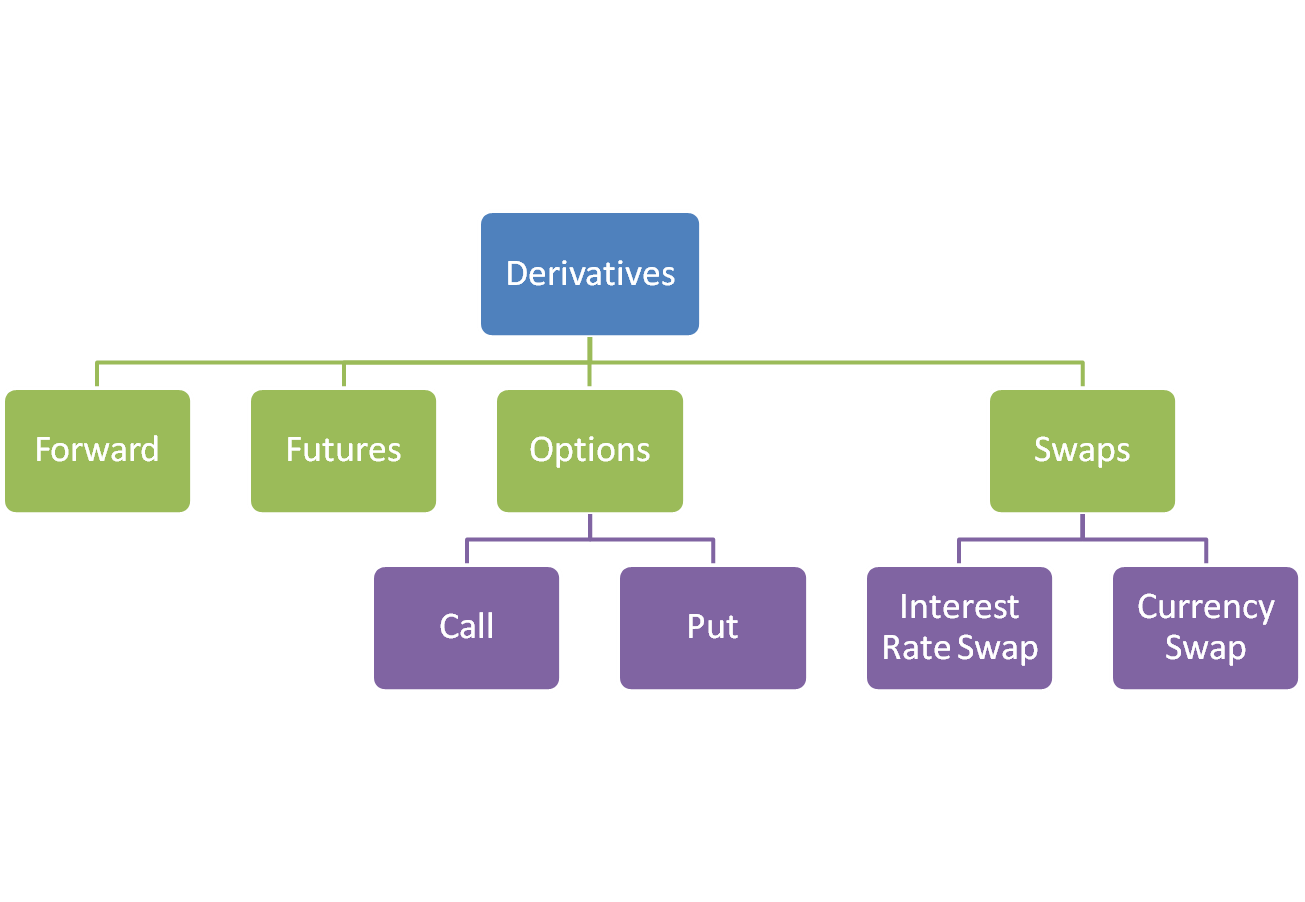

Understanding how futures, options and forward contracts work will help make sense of financial markets. Futures, options and forward contracts belong to a group of financial securities known as derivatives. The profit or loss resulting from trading such securities is directly related to, or derived from, another asset, such as a stock. There are, however, crucial differences between these three derivative securities, which you should understand before investing in them.

An option gives the holder the right -- but not the obligation -- to buy or sell an asset at a specific price on a specific date.

A call option represents the right to buy, while a put option represents the right to sell. Forward contracts are binding agreements to buy or sell an asset at a specific price on a specific date. One party to such an agreement will have an obligation to buy, and the other will have an obligation to sell. Such contracts can involve practically anything of value, including stocks, bonds, foreign currencies, agricultural commodities such as corn or soybeans, and valuable metals, including gold and silver.

The asset that changes hands is referred to as the underlying asset, or simply "the underlying. A futures contract is simply a standardized forward agreement.

If you are a cereal manufacturer and buy a lot of corn, it would be time-consuming to negotiate a different forward contract with every corn farmer.

To streamline the process, large commodities exchanges offer standardized agreements through which corn, for example, is traded in increments of 1, bushels on specific dates. The specifications of corn to be delivered are also set.

That way, the buyer and seller can select one of the standard contracts, changing only the quantity as suits their needs. The major difference between an option and forwards or futures is that the option holder has no obligation to trade, whereas both futures and forwards are legally binding agreements.

Also, futures differ from forwards in that they are standardized and the parties meet through an open public exchange, while futures are private agreements between two parties and their terms are therefore not public. Options can be standardized how royal mail shares will be allocated traded through an exchange or they can be privately bought or sold, with terms forex stop loss atr to suit the needs of the parties involved.

Another key difference is that you must always pay money to buy an option because having the choice to exercise the option is a privilege. When entering a forward or futures agreement, however, what are forwards futures call put options bonds debentures pay nothing at the time of the agreement. You place yourself under an obligation to either buy or sell on the expiration date.

Options An option gives the holder the right -- but not the obligation -- to buy or sell an asset at a specific price on a specific date. Forwards Forward contracts are binding agreements to buy or sell an asset at a specific price on a specific date. Futures A futures contract is simply a standardized forward agreement.

Key Differences The major difference between an option and forwards or futures is that the option holder has no obligation to trade, whereas both futures and forwards are legally binding agreements.

References The Options Guide: Difference Between a Futures Contract and a Forward Contract OptionTradingPedia. Stock Options Cheat Sheet What Is Fixed Income Derivatives? How to Trade Leveraged Stock Options Stock Market Vs. Expected Return of a Call Option How do I Trade Stock Futures? Dollar Futures Derivatives Vs. More Articles You'll Love. Expected Return of a Call Option. How do I Trade Stock Futures? How to Invest in Brent Crude.

Futures contract - Wikipedia

How to Hedge Futures Contracts With Options. Stock Options Cheat Sheet. What Is Fixed Income Derivatives? How to Trade Leveraged Stock Options.

The Difference Between Options and Futures | Investopedia

What Happens at the Expiration of a Vertical Spread? About Us Careers Investors Media Advertise with Us Check out our sister sites. Privacy Policy Terms of Use Contact Us The Knot The Bump.