Put call parity for foreign currency options

I am self-studying for an actuarial exam on models for financial economics. I am having difficulty thinking about the put-call parity for currency options, specifically how use the notation.

Here is the problem:. Sign up for our newsletter and get our top new questions delivered to your inbox see an example.

Foreign exchange option - Wikipedia

Now divide everything by 1. Now convert to pounds at spot rate: A call lets to purchase one unit of underlying for some strike price x. So a call on GBP in USD lets us buy 1 unit of GBP for price x.

Both cases above are the same transaction outflow USD for inflow GBP with options. Based on the base currency, we can view it as a call USD base or a put GBP base. This is what Alex C mentioned in his answer. In foreign exchange a contract can equally be seen as a put or a call, depending on the point of view: This is not Put-call-parity, which is not needed for this problem, it is just two names for the same thing.

Difficulty understanding put-call parity for currency options - Quantitative Finance Stack Exchange

All you need to do is to invert the strike and convert the price to the other currency: By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service.

Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges.

Put-call parityQuestions Tags Users Badges Unanswered. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics.

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. Difficulty understanding put-call parity for currency options.

Here is the problem: Please tell me if my interpretation is correct: The problem is that the first argument of those options do not appear to be rates.

Foreign exchange option - Wikipedia

I don't see how to take what we're given, and convert to what the problem is asking us to find. Did you find this question interesting? Try our newsletter Sign up for our newsletter and get our top new questions delivered to your inbox see an example. Please click the link in the confirmation email to activate your subscription. Alex C 4, 5 I guess I'm not seeing why inverting the strike price and converting the currency will convert between a call of one denomination and a put of the other denomination.

Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password.

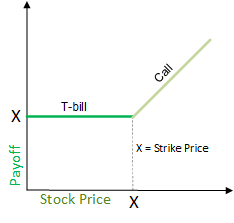

An Example of Put-Call Parity for Currency Options

Post as a guest Name. In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. Quantitative Finance Stack Exchange works best with JavaScript enabled.

Done share improve this answer. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.