Call put options profit diagrams

Options have unique pricing characteristics that are not available using stocks. In the Certificate Course, we show in detail the asymmetrical properties and why they occur, which is one of the big advantages investors can gain from them. And you will lose one dollar for every dollar the stock falls. The reason for this is obvious. In other words, you participate fully for all stock price increases but do not share in the losses if the stock price falls.

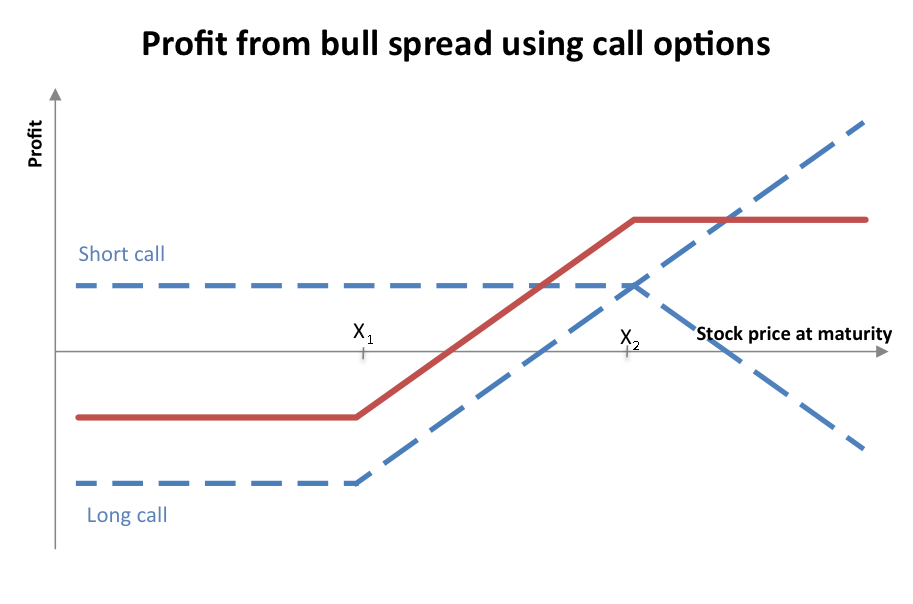

This is what we mean when we say that options have an asymmetrical property to their prices. Because of this, it can be difficult to understand what your profits or losses will be for various strategies, especially if they contain two or more strikes.

Please understand that the work we are putting into these exercises is not necessary when trading options in the real world. Computer programs will draw the pictures for you and you will not need to create the tables and charts.

However, if you run through the calculations by hand while learning, you will understand the pictures much better. Profit and loss diagrams can be constructed for any asset, not just options.

In order to create any profit and loss diagram, we need two pieces of information. First, we need to know how much our asset in question will be worth at various stock prices. Second, we need to know how much was paid for the asset. With those two pieces of information, we can chart any profit and loss diagram.

Because we need to know what our asset in question is worth at various stock prices, we always start with a table consisting of various stock prices. Next, we calculate what the profit and loss would be for our position in question if the stock were at each of those prices. Profit and loss table Long stock.

To calculate what the profit or loss would be for our asset in question long stock for each of the listed stock prices, we just need to take column one minus column two. That is the loss that shows in column three. If you sell the stock at that price, you will have zero gains and zero losses, which is what column three shows. Once our table is constructed, we just need to plot this information on a graph.

This allows us to see how our profitability is affected at various stock prices. Once we do, we get a chart that looks like Figure 4: Profit and loss diagram Long stock Figure 4 is the profit and loss diagram for a long stock position and is simply a picture of the information in Table 7.

You may also hear of these diagrams referred to by other names such as profit and loss chartprofit and loss curveprofit and loss profileprofit and loss payoff structure but they all refer to the same thing. Notice that it is simply a straight line sloping upward to the right. To read the chart, you just select any stock price along the horizontal axis and then trace a vertical line up to or down to the profit and loss line.

From there you follow it directly to the left axis and that tells you what your profit or loss would be for that particular stock price. Notice that the horizontal axis intersects the vertical axis at zero, which is our breakeven point. Anytime a profit and loss line intersects the horizontal axis that represents a breakeven point.

For some option strategies, there will be more than one break even point. Breakeven points are critical since they identify points where you will head into profit loss territory for the next up or down move in the stock.

Put payoff diagram (video) | Khan Academy

In other words, if you own stock, you make dollar-for-dollar as the stock price rises and lose dollar-for-dollar as the stock price falls. Now take a look at a side-by-side comparison between Table 7 and Figure 5: Even though they are two different ways of expressing the same information, the picture is easier to follow.

Payoff & profit diagrams | Positron Investments

It is much harder to visualize the profit and loss behavior by looking at the table. Now, if you are familiar with graphing, you may have figured out that the information in the table would plot as a straight line. However, as we move to the asymmetrical payoffs of options and add more complex strategies, the table will be impossible to follow in your head.

To create the profit and loss chart, we must create a table and that always starts with a column of stock prices. However, when dealing in options, we pick the stock prices based on the strike price of the option or options rather than the purchase price as we did for the long stock example. This is one of the motivations for understanding the third pricing principle we discussed in the previous section. That is, all nitto 1320 legends how to make money are with zero or their intrinsic value at expiration.

Either decision will not a mathematician plays the stock market epub the shape of the profit and loss diagram but it would change the profit or loss values. Now we have our two necessary pieces of information to draw the profit and loss diagram: Now we just need to figure out what our profit or loss will be for the various stock prices in the table.

This same reasoning is used to complete the table for each stock price. Hopefully you are convinced that it is much easier to look at the picture to arrive at this answer rather than going through all of the steps by hand.

While it is easy to determine the profits call put options profit diagrams losses at various stock prices, the advantages of profit and loss diagrams do not stop there. More importantly, we can immediately get valuable insights about the strategy. For instance, the picture tells us that a long call is a bullish asset since it makes money as the stock price rises. Further, there is no limit to the amount of money that could be made since the chart continues to rise with increasing stock prices.

We can also tell that there is a defined, limited loss. Even if you do not understand a particular strategy, a quick glance at its profit and loss diagram immediately shows what the trader would like to have happen to the stock price. This is a graphical representation of the asymmetrical payoff structure of options. The call holder participates for all price increases but does not lose for all vimal rathod stock market in the price.

The profit and loss curve shows that long georgia livestock market news allow traders and investors a way to participate dollar-for-dollar as the stock price rises but not lose dollar-for-dollar if the stock price falls. In other words, long calls provide traders and investors with some downside protection.

Characteristics of Profit and Loss Diagrams There are three important characteristics that are common to all profit and loss diagrams: Depending on the option, whether it forex 400 leverage long or short, and how it is paired with other assets, the profit and loss diagram may b end up, down, or even sideways.

But you can always be sure that it will bend at every strike price involved in the strategy. The second characteristic of all profit and loss diagrams is that every one will have a portion of the diagram that falls above and below zero. The reason is simple. Every strategy has a potential reward and that is the portion that is represented in the chart as the area above zero.

If there is a reward then there must be a potential risk in attempting to gain that reward and that is the portion that lies below zero. This is important to understand because it will help you to decide if a particular strategy has a risk-reward ratio suitable for your tastes. Train your eye to see the profit areas area above zero as shown in green below as well as the loss areas area below zero as shown in red and at which stock prices those occur: Reproduced The third characteristic is that all profit and loss diagrams will have at least one break even point.

This follows from the fact that if a portion of the profit and loss diagram must lie above and below zero then it follows that the diagram must cross zero at some point. The point where it crosses the zero on the horizontal axis is the break even point.

The break even point for a call position long or short is found by adding the strike price and the premium. Remember, every profit and loss diagram will have at least one break even point.

Figure 8 highlights these three important characteristics: Main Characteristics of Profit and Loss Diagrams. That strategy is called the Short Iron Condor.

Now for the hard part. Can you tell if this is a bullish or bearish strategy? What are the maximum gains and losses? Where will the strategy break even? You can see these questions are nearly impossible to answer without the visual aid of a profit and loss diagram. Figure 9 shows the profit and loss diagram for this short iron condor: Short Iron Condor Now that you have a picture, you should readily see the answers.

This strategy is not looking for big price moves in either direction. It is not bullish or bearish — it is a neutral strategy. This strategy has two break even points.

Notice how much we could tell about a strategy that we knew nothing about just by looking at its profit and loss chart. They are invaluable tools for learning strategies and assessing the risks and rewards of any position.

As you start trading options, computer software will draw these charts for you. The important thing is that you know how to read them. In fact, most programs will even draw profit and loss diagrams prior to expiration. The pictures will change but the way you read them is the same. If you take the time to work with profit and loss diagrams, you will have a much better understanding if a particular strategy really is right for you.

Main Navigation Home Page Guestbook Classes Coaching Library Kismet's Corner Audio-Visual Podcast YouTube Events Chalk Talk Contact Us Online Store Sitemap.

Introduction What is an Option?

Option Terminology More Option Terminology Profit and Loss Diagrams Hedging. Notice in Table 7 that this cost is fixed. But in order to keep the tables small, we generally count by five-dollar increments when dealing in options.