Options strategies guts

Short Strangle (Sell Strangle) Explained | Online Option Trading Guide

The long gut is an options trading strategy that can be used to try and profit when you are unsure which direction the price of a security will move in, but are confident it will make a sizable move. It's a limited risk strategy with unlimited potential profits, and is very simple to use, because just two transactions are required. It has a higher upfront cost than some comparable strategies, but the maximum loss is actually relatively low. Please see below for further details. The long gut is a strategy for a volatile market, and is designed to profit when you are expecting a security to experience a high level of volatility.

It's a good strategy to use when you are confident that the price of a security will make a big move, but you aren't entirely sure which direction it will move in.

Despite the high upfront costs of this debit spread, the risk is considered quite low. Coupled with the fact that it's very straightforward, this makes the long gut suitable for beginner traders. As we have already mentioned, the long gut is very straightforward. All you need to do is buy in the money call options and buy an equal amount of in the money put options, all based on the relevant security and with the same expiration date.

The only two decisions you need to make are which strikes to use and which expiration date.

The calls and the puts should be an equal amount in the money i. In our opinion, you should use strikes that are relatively close to the current trading price of the underlying security so that you keep the upfront cost lower. The expiration date you choose to use will also affect the upfront cost.

If you choose a close expiration date, then the cost will be cheaper due to the reduced time value. However, the flipside to this is that there won't be as much time for the price of the underlying security to move enough to return a profit to you.

If you are confident that the price of the underlying security will move quickly then a short term expiration date is probably best. If you want to allow more time for the price to move, then a longer term expiration date is a better choice.

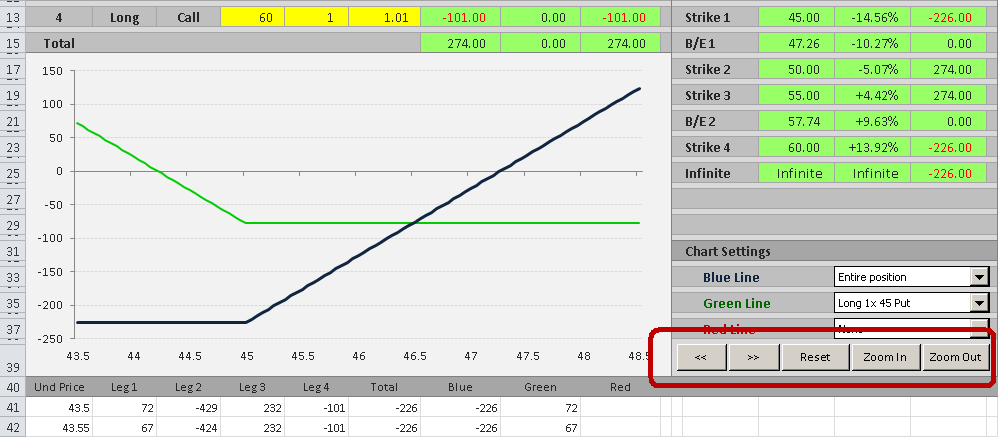

Below is an example of a long gut can be used. To keep things simple we have used hypothetical prices and not included commission costs. You can make potentially unlimited profits from this strategy if the underlying security moves significantly in price.

Long Guts

A sizable price move, in either direction, will result in one leg returning a decent profit while you will only lose the amount invested in the other leg. The strategy will return a loss if the price of the underlying security only moves slightly or stays the same, but it will return an overall profit whenever the profit of one leg is greater than the loss of the other leg.

To help you understand the long gut fully, we have provided some illustrations below of what might happen when applying it shown in the example above. We have also shown the formulas that you can apply to calculate the potential profits, losses, and break-even points.

If at any point before the options expire you feel the price of the underlying security isn't going to move sufficiently to return a profit you may want to consider closing your position to recover any remaining time value and minimize your losses. To do this, you simply sell the options that you own. You may also want to do this if the strategy is in profit and you want to realize the profits early. There are two alternative strategies to the long gut that are very similar and you may want to consider these as alternatives.

The long straddle is cheaper to establish than the long gut, because you buy at the money options instead of in the money options. You can read more about this strategy here.

The long strangle is cheaper still, because you buy out of the money options.

For more details on this strategy, please click here. The long gut is a useful and simple strategy that can be used to try and make a profit when you have a volatile outlook.

As there are only the two transactions involved, the commissions are relatively low and the strategy is fairly simply to use. There are no margin requirements, and only a low trading level is required. Home Glossary of Terms History of Options Trading Introduction to Options Trading Definition of a Contract What is Options Trading?

Long Gut Strategy The long gut is an options trading strategy that can be used to try and profit when you are unsure which direction the price of a security will move in, but are confident it will make a sizable move.

The Key Points Volatile Strategy Suitable for Beginners Two Transactions buy calls and buy puts Debit Spread upfront cost Low Trading Level Required. Section Contents Quick Links.

Long Straddle Option StrategyWhen to Use a Long Gut The long gut is a strategy for a volatile market, and is designed to profit when you are expecting a security to experience a high level of volatility.

How to Establish a Long Gut As we have already mentioned, the long gut is very straightforward. This is Leg A.

This is Leg B. Long Straddle and Long Strangle There are two alternative strategies to the long gut that are very similar and you may want to consider these as alternatives. Summary The long gut is a useful and simple strategy that can be used to try and make a profit when you have a volatile outlook.

Taking all of this into account, this is a good options trading strategy for beginners. Read Review Visit Broker.