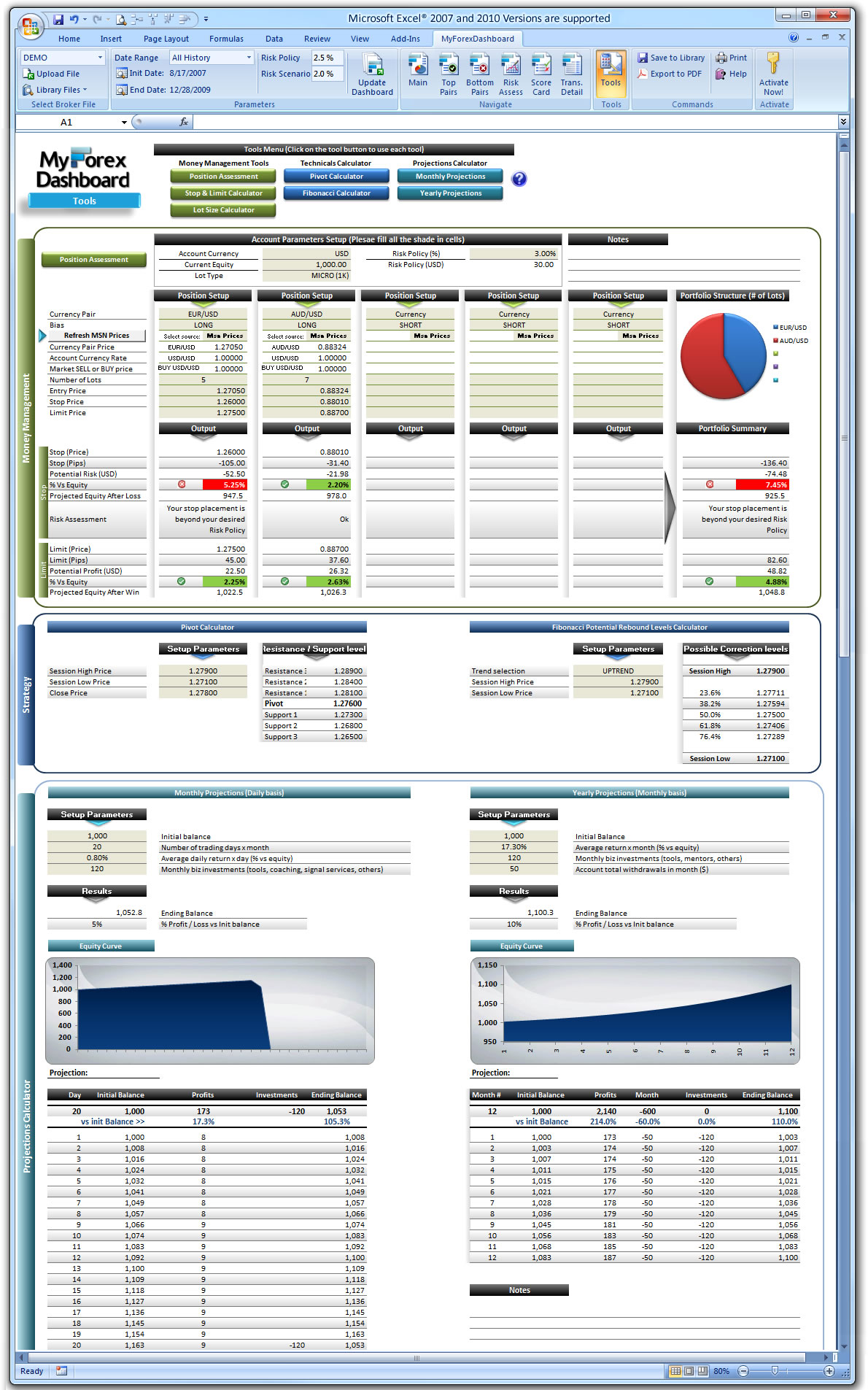

Forex journal example

Since central banks, also known as reserve banks, play the crucial role of setting interest rates they need to be followed and studied by a fundamental and even technical Forex trader. Central banks want to achieve financial stability of their currency i. Their primary responsibility is to oversee the monetary policy of a particular country or group of countries in the case of the European Union. Monetary policy refers to the various efforts made to effectively control and manage the amount of money circulating within a nation.

Those investors that are correct in their speculations can predict how the respective currencies should move, and as a result should be able to take the proper long or short positions.

4 Reasons Why You Need A Forex Trading Journal

Central banks act in ways to lessen the effects of inflation on an economy. Inflation refers to a rise in price levels which causes a fall in the purchasing power of a currency.

Inflation accounts for an entire basket of goods and services, not just an increase in the price of one item. Monitoring prices of a particular basket is known as indexing and provides a reliable method of tracking inflationary movement. At times of high inflation, employees will demand more money for their work as the previous hourly wage no longer reflects the same value.

In order to pay their employees more, businesses have to raise their prices so that they can also manage to raise the wages of its employees.

Inflation Interestingly, inflation can be set off by the increase in price of just one crucial item food or energy as well. An example of a volatile commodity that can cause inflation is oil. An increase in the curso forex bh of oil would cause many other items that use it as an input in the production process such as gasoline to also increase in price and therefore begin the inflationary process.

The purchasing power of the currency decreases and the currency loses strength. If inflation is a concern then the central bank will raise interest rates to appease the inflationary pressure.

Higher interest rates will cause inflation to slow because it will cost more for companies and consumers to borrow from banks to fund either investment spending or consumption i.

With more restrictive access to money, forex journal example activity slows down and so do inflationary pressures. The higher interest rate will cause the currency to appreciate in the eyes of investors, both domestic and foreign, as they will benefit from a higher yield on the review forex steam assets.

If the currency is now appreciating relative to other currencies, then Forex traders will buy into it in order to trade with the trend, sending even more money towards that economy. It is therefore a delicate balance that central banks have to strike.

FX News Alert - Forex Alarm and Currency Strength Momentum Software

They would like higher interest rates to strengthen the currency and promote foreign investment, but they must be aware that higher interest rates hurt domestic businesses and consumers that rely on borrowing money from banks.

In the following pages, we shall look at an example of interest rates and central banks, and their impact on the Forex market at work. Online forex trading carries a high degree of risk to how stock brokerage is calculate in icici direct capital and it is possible to lose your entire investment.

Only speculate with money you can afford to lose. Forex trading may not be suitable for all investors, therefore ensure you fully understand the risks involved, and seek independent advice if necessary. Forex Services Forex Trading Terms FAQ.

The Role of Central Banks | Forex Currency Trading | CMS Forex

Trading Software VT Trader VT Key Features Download VT VT Resources Metatrader MT4 Key Features Download MT4 MT4 Resources. Forex Education Forex Overview Online Forex Course Forex Glossary. Forex Resources Live Forex Tools.

Here is my trading journal from the time I started till nowAbout CMS Contact Us About THE Technology. Contact Us search our site here. Overview Online Forex Course Learn the platform. Introduction to the Foreign Exchange What is Forex? Operation Aspects of Trading Lesson 2.

The Definitive Guide to Using a Forex Trading Journal

How Trading Works and Terminology How Forex Trading Works Explanation of Margin and Leveraged Trading Risk Management Lesson 3. A Sample Trade Setting Up An Example Opening two Positions Initial Changes, 4 Hours Later The Next Day, 24 Hours Later Candles Can Paint A Story of Wild Activity - 26 Hours Later Retraction from a Big Move - 30 Hours Later Two Days Later - 48 Hours Later Analysis and Trading Lessons Lesson 4.

Exchange Rates and Supply and Demand Calculations of Exchange Rates Supply and Demand Actors that Affect Supply and Demand Central Banks. Central Banks and Interest Rates The Role of Central Banks Market Reactions to Central Banks — FOMC Example FOMC Example Continued Central Banks You Need to Know Lesson 6.

Fundamental Analysis What are Fundamental Factors? Reaction of the Forex Market to a Fundamental Release Macroeconomic Indicators Inflation and Inflation Indicators Employment Indicators Lesson 7.

Technical Analysis Chart Types Trends Concept of Support and Resistance Trend Reversal Patterns More Reversal Patterns - Various Tops and Bottoms Continuation Patterns More Continuation Patterns Lesson 8. Privacy Policy and Risk Disclosure.