Buying stocks 101

No, you are not required to invest only in penny stocks - investors are generally not restricted to a certain kind of stock based on the amount of money they have.

Although there are fewer shares in the second case, the total value of the investment is the same. But, regardless of how much money you have available to invest, it is very important to understand that penny stocks are generally the highest-risk stocks in the market.

As such, especially if you are a new investor, you might instead want to consider, for instance, blue-chip companies - such as General Electric GE or Microsoft MSFT - which tend to have long-established track records of operations and trade on exchanges that are closely regulated by the SEC.

Investing A Tutorial For Beginner Investors

These characteristics are not found where penny stocks are traded - in the over-the-counter markets. That said, however, remember investing in stocks involves some level of risk, even if you invest in big players.

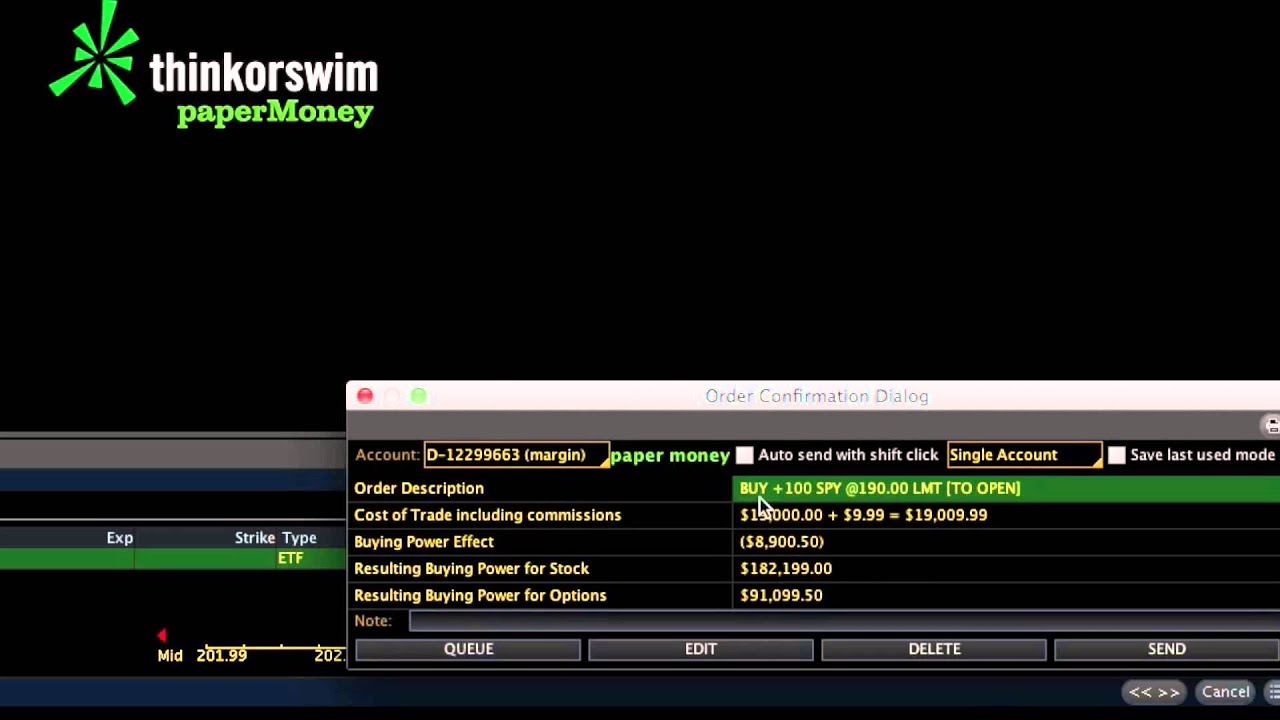

If you want to invest in stocks with relatively little money, it is especially important that you take into account trading commissions and the minimum-deposit requirements imposed by some brokerage accounts. But even though you use a discount broker, remember commission fees act as negative returnsso do try to minimize them as much as possible. Because you are dealing with such a small amount of money, consider limiting the number of different stocks you buy to minimize the commission.

For further reading, see InvestingThe Lowdown on Penny Stocks ,and Don't Let Brokerage Cara klaim bonus 30 instaforex Undermine Your Returns. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. By Investopedia Staff Updated June 8, — 6: Discover more about penny stocks, how they can be bought utilizing ny stock market open on columbus day individual retirement account and the risks penny stock Is the lure of finding a diamond in the rough too strong to ignore?

Then here's a guide to investing in penny stocks. First-time investors beware of these potentially disastrous decisions. Do you find the lure of finding a diamond in the rough too much to ignore?

How to Invest in Stocks - Stock Investing - TheStreet

Then consider penny stocks. Just be aware of the risks.

Although penny stocks are highly speculative, millions of people trade them daily. Here are 10 different types who do. Penny stocks are speculative and buying stocks 101 risky investments. Lack of government and stock exchange oversight and general information leaves penny stock investors open to buying stocks 101 losses.

Smart investors don't give away more money than necessary in commissions and fees. Find out how to save.

Welcome to the wild world of penny stocks. Here's what to expect. Have the stomach for high risk? Consider these alternatives to penny stocks.

A stock that trades at a relatively low price and market capitalization, Refers to May 1,when brokerages changed from a fixed commission Exchanges or over-the-counter markets in which shares of publicly An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable.

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

The Beginner's Guide to Online Stock Trading

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.