Fx forex hedging strategy

GBP Reacts to CB Talk as the Queen Speaks. USD Waits for Fed Speakers; NZD Vulnerable to RBNZ. Yen Aims to Extend Gains, Pound Focus Shifts Back to Politics.

Gold, USD Strong Inverse Correlation and in Confluence. FTSE Further Develops Range on Sharp Turn Lower. Dow Jones Industrial Average Struggles to Hold the Gap Higher. While this may sound foreign to ears hearing it for the first time, logic and common sense dictate as such. This is where analysis comes in, hopefully offering traders an advantage.

And further, this is where risk management plays an even more important role, just as we saw in our Traits of Successful Traders research in which The Number One Mistake Forex Traders Make was found to be sloppy risk management. What is the USD Hedge? The USD hedge is a strategy that can be utilized in situations in which we know the US Dollar will probably see some volatility.

A good example of such an environment is Non-Farm Payrolls. With The United States reporting the number of new non-farm jobs added, quick and violent moves can transpire in the US Dollar, and as traders this is something we might be able to take advantage of. Another of these conditions is the US Advance Retail Sales Report.

This number is issued on the 13 th of the month approximately High impact USD events can be a great way to look for USD volatility. In all of these situations — it is absolutely impossible to predict what is going to happen. But once again, as a trader — it is not our job to predict. In the USD hedge, we look to find opposing currency pairs to take off-setting stances in the US Dollar.

Forex Hedging: Creating a Simple Profitable Hedging Strategy

So, we find one pair to buy the US Dollar; and a different pair to sell the US Dollar. Hedging has a dirty connotation in the Forex market.

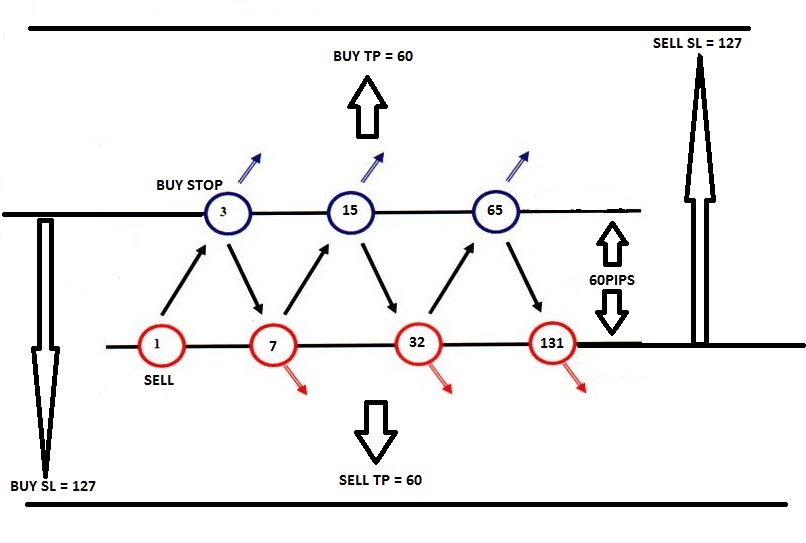

In the Forex market, hedging is often thought of as going long and short on the same pair at the same time. What Allows the USD Hedge to W ork? Advantageous risk-reward ratios are an absolute necessity in the strategy and without them — the USD hedge will not work properly. We looked at this topic in depth in the article How to Identify Positive Risk-Reward Ratios with Price Action.

The trader looks to buy the dollar in a pair, using a 1-to-2 risk reward ratio; and then the trader looks to sell the dollar in a pair, also using a 1-to-2 risk to reward ratio. The risk and reward amounts from each setup need to be roughly equal.

FOREX Hedging Strategy presented by a MillionaireThen, when the US dollar begins its movement, the objective is for one trade to hit its stop, and the other to move to its profit target. But because the trader is making two times the amount on the winner than they lose on the other position, they can net a profit simply by looking to utilize win-one, lose-one logic. There are numerous ways to buy or sell US dollars, and theoretically traders could look to utilize the strategy on any of them.

But to give ourselves the best chances of success, we can integrate some of the aforementioned analysis to try to make the strategy as optimal as possible. There are quite a few ways to decide how to do this. Personally, I prefer price action.

Forex Hedging: Creating a Simple Profitable Hedging Strategy

We looked at quite a few ways of doing this in The Forex Traders Guide to Price Action. James is available on Twitter JStanleyFX. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Market News Headlines getFormatDate 'Wed Jun 21 GBP Reacts to CB Talk as the Queen Speaks getFormatDate 'Wed Jun 21 Technical Analysis Headlines getFormatDate 'Wed Jun 21 Gold, USD Strong Inverse Correlation and in Confluence getFormatDate 'Wed Jun 21 Education Beginner Intermediate Advanced Expert Free Trading Guides.

News getFormatDate 'Wed Jun 21 News getFormatDate 'Tue Jun 20 The US Dollar Hedge getFormatDate 'Thu Sep 12 Trading is about risk management, and looking to focus on the factors that we know. This strategy focuses on capitalizing on US Dollar volatility, and using risk management to offer potentially advantageous setups in the market. The Doji getFormatDate 'Tue Sep 10 Upcoming Events Economic Event. Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors.

CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar. EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS.

DailyFX is the news and education website of IG Group.