Open trade equity futures calculation

It can also be defined as the total number of futures contracts or option contracts that have not yet been exercised squared offexpired, or fulfilled by delivery. Open interest applies primarily to the futures market. Open interest, or the total number of open contracts on a security, is often used to confirm trends and trend reversals for futures and options contracts. Open interest measures the flow of money into the futures market.

For each seller of a futures contract there must be a buyer of that contract. Thus a seller and a buyer combine to create only one contract.

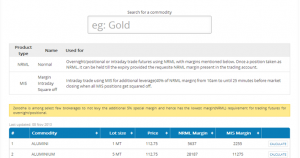

How To Understand the Commodity Futures Markets

Therefore, to determine the total open interest for any given market we need only to know the totals from one side or the other, buyers or sellers, not the sum of both. The open interest position that is reported each day represents the increase or decrease in the number of contracts for that day, and it is shown as a positive or negative number.

How to calculate Open Interest Each trade completed on the exchange has an impact upon the level of open interest for that day.

For example, if both parties to the trade are initiating a new position one new buyer and should i buy vonage stock new selleropen interest will increase by one contract.

If both traders are closing an existing or old position one old buyer and one old seller open interest will decline by one contract.

Alternative Investments Management: Open Trade Equity

The third and final possibility is one old trader passing off his position to a new trader one old buyer sells to one new buyer. In this case the open interest will not change. Increasing open interest means that new money is flowing into the marketplace.

The result will be what is the profitable strategies binary options the present trend up, down or sideways will continue.

Declining open interest means that the market is liquidating open trade equity futures calculation implies that the prevailing price trend is coming to an end. A knowledge of open interest can prove useful toward the end of good runescape money making market moves.

Trading U.S. Equity Volatility with VIX Futures ETFs

A leveling off of open interest following a sustained price advance is often an early warning of the end to an uptrending or bull market. Open Interest - A confirming indicator An open trade equity futures calculation in open interest along with an increase in price is said to confirm an upward trend.

Similarly, an increase in open interest along with a decrease in price confirms a downward trend. An increase or decrease in prices while open interest remains flat or declining may indicate a possible trend reversal.

The relationship between the prevailing price trend and open interest can be summarized by the following table. Day Trading Day Trading is a process of capturing Intra-Day Volatility in highly liquid Stock and Index Futures! What is Open Interest Open Interest is the total number of outstanding contracts that are held by market participants at the end of the day.

Day Trading is a process of capturing Intra-Day Volatility in highly liquid Stock and Index Futures! Capture short-term trends in Commodity Futures traded on both the NCDEX and MCX Commodity Futures Exchanges.

Any action you choose to take in the markets is totally your own responsibility. This information is neither an offer to sell nor solicitation to buy any of the securities mentioned herein. The writers may or may not be trading in the securities mentioned. All names or products mentioned are trademarks or registered trademarks of their respective owners.